Daily Market Analysis from ForexMart

4 posters

Page 1 of 39

Page 1 of 39 • 1, 2, 3 ... 20 ... 39

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

Hello forum members!

Good day!

I am Andrea, an official representative of ForexMart.

Me and my colleagues will provide you daily forex analysis on this thread to help you increase your trading efficiency as well as maximizing your profit. Suggestions, comments or opinions are all welcome. We will also be glad to attend to your inquiries.

We hope to hear from you soon!

Thank you!

Best regards,

ForexMart

Good day!

I am Andrea, an official representative of ForexMart.

Me and my colleagues will provide you daily forex analysis on this thread to help you increase your trading efficiency as well as maximizing your profit. Suggestions, comments or opinions are all welcome. We will also be glad to attend to your inquiries.

We hope to hear from you soon!

Thank you!

Best regards,

ForexMart

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

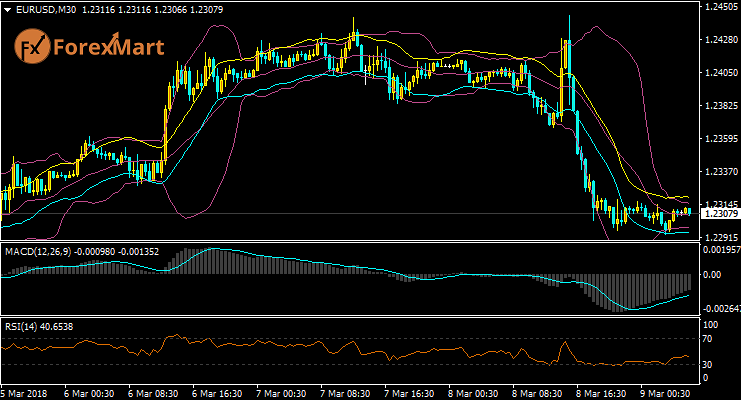

EUR/USD Technical Analysis: March 9, 2018

The euro paired with the dollar had whipsawed yesterday and pulled lower after the monetary policy meeting of the ECB. The focus of the meeting was back again about removing the easing bias. The European Central Bank (ECB) decided to kept the interest rates unchanged and further confirmed the timeline of the Quantitative Easing (QE) until the end of September. Moreover, the unemployment claims edged higher from its 48-year low over the past 24 hours. But the US labor market remained tight to support the American currency.

The EUR/USD pair moved downwards and formed a triple top followed by a head and shoulder reversal pattern. The resistance entered the 1.2446 region which is close to its March highs, while the support touched the 1.2308 level around the 10-day moving average. The momentum had a reversal and approached the negative territory. The MACD index showed a crossover sell signal as well as the fast stochastic indicator. As of this writing, the MACD histogram prints in the red with a descending sloping momentum which reflects lower prices.

The euro paired with the dollar had whipsawed yesterday and pulled lower after the monetary policy meeting of the ECB. The focus of the meeting was back again about removing the easing bias. The European Central Bank (ECB) decided to kept the interest rates unchanged and further confirmed the timeline of the Quantitative Easing (QE) until the end of September. Moreover, the unemployment claims edged higher from its 48-year low over the past 24 hours. But the US labor market remained tight to support the American currency.

The EUR/USD pair moved downwards and formed a triple top followed by a head and shoulder reversal pattern. The resistance entered the 1.2446 region which is close to its March highs, while the support touched the 1.2308 level around the 10-day moving average. The momentum had a reversal and approached the negative territory. The MACD index showed a crossover sell signal as well as the fast stochastic indicator. As of this writing, the MACD histogram prints in the red with a descending sloping momentum which reflects lower prices.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

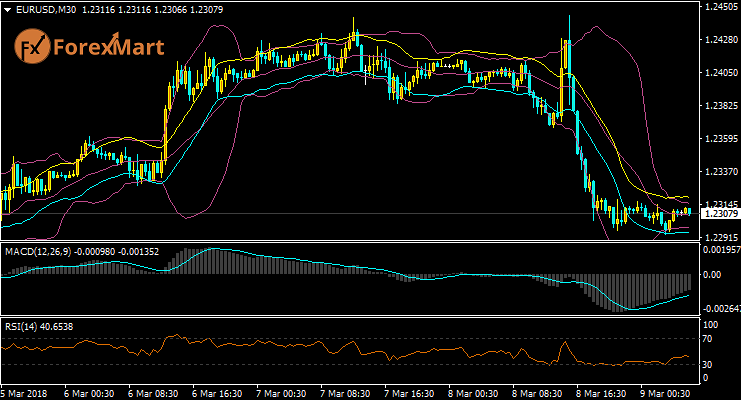

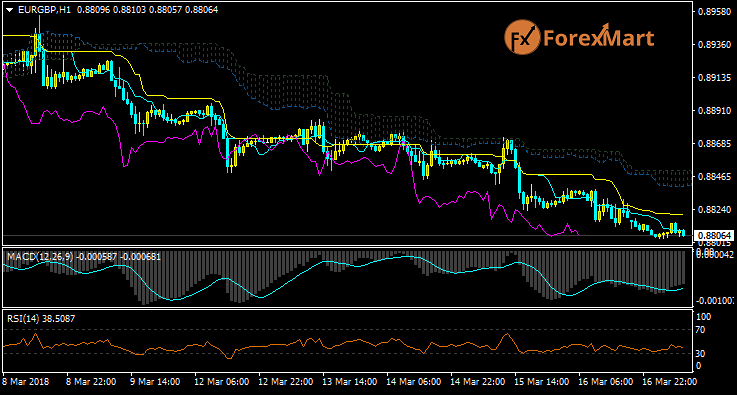

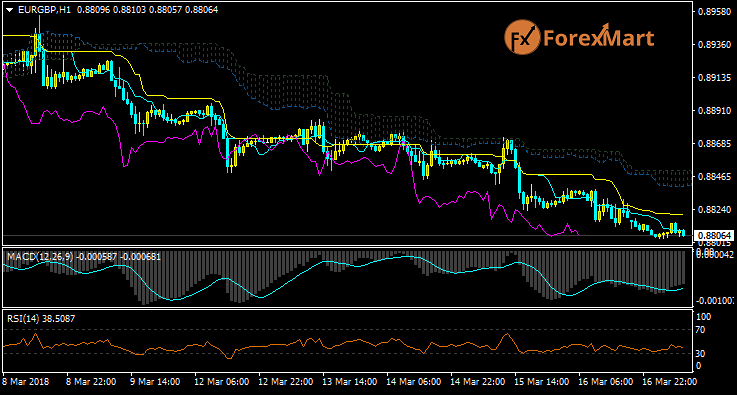

EUR/GBP Technical Analysis: March 19, 2018

The EUR/GBP pair has plenty of noise during the trading course last week. However, the current position is in the significant consolidation zone. The level below the 0.87 is the “floor” of the market and the area above 0.90 is the “ceiling”. The pair seems appealing to short-term traders but there could be an ascending trend in general. We are waiting for the results of the talks between the United Kingdom and the European Union, upon the clarity of this, the EURGBP will strive to conduct significant moves.

Despite of this, the market may still offer significant opportunities but the longer-term trader will continue to struggle and possibly hold the range that provides benefits in trading despite any fluctuations. An ability to break down under the 0.87 handle will push the market to the 0.85 eventually. Otherwise, a cut through on top of the 0.90 region would give rise to a “buy-and-hold” scenario. The level above 0.93 handle is the most recent high. As of this writing, there are no break out expected in the next few weeks and would lead to a range bound short-term market.

The EUR/GBP pair has plenty of noise during the trading course last week. However, the current position is in the significant consolidation zone. The level below the 0.87 is the “floor” of the market and the area above 0.90 is the “ceiling”. The pair seems appealing to short-term traders but there could be an ascending trend in general. We are waiting for the results of the talks between the United Kingdom and the European Union, upon the clarity of this, the EURGBP will strive to conduct significant moves.

Despite of this, the market may still offer significant opportunities but the longer-term trader will continue to struggle and possibly hold the range that provides benefits in trading despite any fluctuations. An ability to break down under the 0.87 handle will push the market to the 0.85 eventually. Otherwise, a cut through on top of the 0.90 region would give rise to a “buy-and-hold” scenario. The level above 0.93 handle is the most recent high. As of this writing, there are no break out expected in the next few weeks and would lead to a range bound short-term market.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

GBP/USD Fundamental Analysis: March 21, 2018

The British pound against the U.S. dollar had a downward correction due to the pressure from the dollar which has been strengthening across markets yesterday. The pair positions just over the area of 1.40 and there seems to be no threat for the bulls but it is still uncertain who will lead the trend.

There will be high volatility in the market with the expectation of the FOMC rate announcement which would then be followed by a press conference. It is highly anticipated that the Fed will raise their rates for the first time, which is highly possible. However, we cannot be certain if the market expectations of a hawkish decision would be met, which the market bulls area also hoping for.

However, if the greenback weakens, this would come about just for a short period with the incoming data to dominate the market and boost the dollar. For tomorrow, we have the BOE meeting to look forward to but it is yet to be known if this will have a hawkish tone, in consideration of the Brexit talks in the past few weeks. If this happens, traders should expect for volatility.

Considering all this, traders are suggested not to presume any outcome or direction and trade deciding on the how the situation presents. It is best to wait for the markets to settle down then decide later on when the market has stabilized. For today, the FOMC meeting will be the center of attention that could result in consolidation in the market.

The British pound against the U.S. dollar had a downward correction due to the pressure from the dollar which has been strengthening across markets yesterday. The pair positions just over the area of 1.40 and there seems to be no threat for the bulls but it is still uncertain who will lead the trend.

There will be high volatility in the market with the expectation of the FOMC rate announcement which would then be followed by a press conference. It is highly anticipated that the Fed will raise their rates for the first time, which is highly possible. However, we cannot be certain if the market expectations of a hawkish decision would be met, which the market bulls area also hoping for.

However, if the greenback weakens, this would come about just for a short period with the incoming data to dominate the market and boost the dollar. For tomorrow, we have the BOE meeting to look forward to but it is yet to be known if this will have a hawkish tone, in consideration of the Brexit talks in the past few weeks. If this happens, traders should expect for volatility.

Considering all this, traders are suggested not to presume any outcome or direction and trade deciding on the how the situation presents. It is best to wait for the markets to settle down then decide later on when the market has stabilized. For today, the FOMC meeting will be the center of attention that could result in consolidation in the market.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

USD/CAD Technical Analysis: March 26, 2018

The American currency plummeted against its Canadian counterpart during the previous trading session and began to move near the 1.31 handle and break the 1.30 region. The oil markets performed pretty well which make sense. It seems that the market will find further reasons to chop around the 1.28 zone, which appears to offer support.

The cluster seen in this region served as the current support but this indicates a negative note as the “two-week shooting star” pattern was formed after a complete round trip. Alternately, an ability to break above these 2 candles would likely show a bullish sign but the USD/CAD is preparing to move back and forth amid concerns on trade war breakout.

It seems that the short-term traders will prevail over the market next week with the 1.28 region as the floor and 1.31 would act as the ceiling. Hence, the situation might be very choppy and tough, however, breaking on top of the 2 candle will clear the way through the 1.35 handle. Market players should observe the WTI Crude Oil and a gap over $70 is enough to break the market downwards.

The American currency plummeted against its Canadian counterpart during the previous trading session and began to move near the 1.31 handle and break the 1.30 region. The oil markets performed pretty well which make sense. It seems that the market will find further reasons to chop around the 1.28 zone, which appears to offer support.

The cluster seen in this region served as the current support but this indicates a negative note as the “two-week shooting star” pattern was formed after a complete round trip. Alternately, an ability to break above these 2 candles would likely show a bullish sign but the USD/CAD is preparing to move back and forth amid concerns on trade war breakout.

It seems that the short-term traders will prevail over the market next week with the 1.28 region as the floor and 1.31 would act as the ceiling. Hence, the situation might be very choppy and tough, however, breaking on top of the 2 candle will clear the way through the 1.35 handle. Market players should observe the WTI Crude Oil and a gap over $70 is enough to break the market downwards.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

GBP/USD Fundamental Analysis: April 2, 2018

The GBP/USD pair continued trading around the 1.40 support zone which is expected to be the battleground between the bears and the bulls in the near term. However, it is difficult to make a conclusion since today is a holiday in many countries in celebrating the Easter Sunday. Hence, liquidity and volatility are predicted to be extremely low.

The Cable managed to move over the 1.42 level in the past few weeks amid the dollar weakening and also because the BOE’s hawkishness which continues to become a stronger economy as the Brexit process become smoother. The process resumed a slow, steady and continuous manner and it would take less than a year prior to the completion of the process.

So far, the British economy supported for such improvement as the process continue to smoothen and the UK had a positive performance which helped the Bank of England to conduct a rate increase during this period.

The resumption of a stable economy is beneficial for the central bank to consider further rate hikes ahead and this helped the BOE to maintain a hawkish stance. These events pushed the pair near its highs in the short-term range but it met a lot of selling as the American currency strengthen. As a result, the GBPUSD pair hovered around the significant level of 1.40. In case that the support was broken, the bears will have an opportunity to dominate again the market.

Ultimately, there is no major news from the UK or the US since its holiday in most parts of the world which indicates that the volatility and liquidity would be low for that day.

The GBP/USD pair continued trading around the 1.40 support zone which is expected to be the battleground between the bears and the bulls in the near term. However, it is difficult to make a conclusion since today is a holiday in many countries in celebrating the Easter Sunday. Hence, liquidity and volatility are predicted to be extremely low.

The Cable managed to move over the 1.42 level in the past few weeks amid the dollar weakening and also because the BOE’s hawkishness which continues to become a stronger economy as the Brexit process become smoother. The process resumed a slow, steady and continuous manner and it would take less than a year prior to the completion of the process.

So far, the British economy supported for such improvement as the process continue to smoothen and the UK had a positive performance which helped the Bank of England to conduct a rate increase during this period.

The resumption of a stable economy is beneficial for the central bank to consider further rate hikes ahead and this helped the BOE to maintain a hawkish stance. These events pushed the pair near its highs in the short-term range but it met a lot of selling as the American currency strengthen. As a result, the GBPUSD pair hovered around the significant level of 1.40. In case that the support was broken, the bears will have an opportunity to dominate again the market.

Ultimately, there is no major news from the UK or the US since its holiday in most parts of the world which indicates that the volatility and liquidity would be low for that day.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

EUR/USD Fundamental Analysis: April 16, 2018

Missile launch directed to the specific target in Syria from the U.S. and their allies although the effect is not that big impact. Last week, there are topics regarding the possibility of a war between the U.S. and Syria. The situation is worsening that resulted in choppiness in the market.

A lot of investors has become anxious because of choppiness and the market has become more appealing. Hence, the trend was seen to have consolidated and trades in a range. The attacks over the weekend were said to be from the United States. On a lighter note, this is just for short-term which happened one time that cooled down concerns about a war. This has largely calmed down the market that is reflected in the market in the present condition.

Euro has been trading in a range for a number of weeks already and the tendency to break out in any direction is not clearly visible at this time. Although, there are breakout attempts on either side but did not come out with anything due to uncertainties caused by various factors including the area of Syria, the trade war between China and the U.S. as well as, the QE program.

For today, the retail sales data from the U.S. is unexpected to be released today as the first day of the week. Nonetheless, there is a slow data for today. Excluding the geopolitics concern, this data is anticipated to be more appealing that could initiate the trend for short-term.

Missile launch directed to the specific target in Syria from the U.S. and their allies although the effect is not that big impact. Last week, there are topics regarding the possibility of a war between the U.S. and Syria. The situation is worsening that resulted in choppiness in the market.

A lot of investors has become anxious because of choppiness and the market has become more appealing. Hence, the trend was seen to have consolidated and trades in a range. The attacks over the weekend were said to be from the United States. On a lighter note, this is just for short-term which happened one time that cooled down concerns about a war. This has largely calmed down the market that is reflected in the market in the present condition.

Euro has been trading in a range for a number of weeks already and the tendency to break out in any direction is not clearly visible at this time. Although, there are breakout attempts on either side but did not come out with anything due to uncertainties caused by various factors including the area of Syria, the trade war between China and the U.S. as well as, the QE program.

For today, the retail sales data from the U.S. is unexpected to be released today as the first day of the week. Nonetheless, there is a slow data for today. Excluding the geopolitics concern, this data is anticipated to be more appealing that could initiate the trend for short-term.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

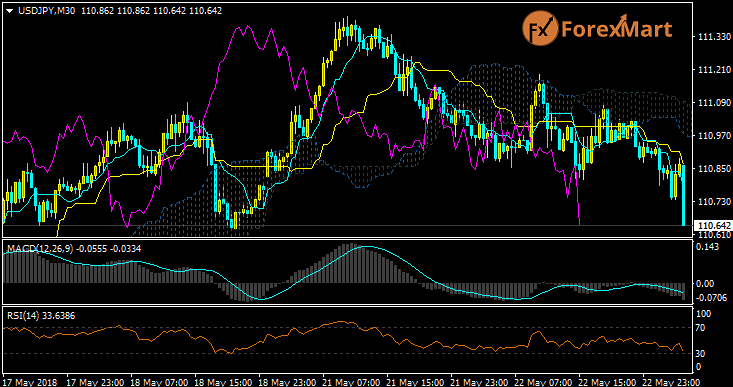

USD/JPY Technical Analysis: May 7, 2018

Investors are observing the movement of the 10-year U.S. Treasury note futures contract following the appreciation of the USD/JPY pair. The statements and the recent jobs report influencing the 10-year Treasury notes, which is likely to be bullish especially that it is in inverse relationship to the interest rates. An increase in the T-notes would then lead to a drop in yields. A weaker Treasury yield would bring pressure to the Japanese major pair.

The USD/JPY pair began the week with higher expectations of the interest rates prior to the latest Fed monetary policy statement yet, the price movements suggests the disappointment to the reports. The pair rallied for the week to the highest level at 110.028 since February 5. However, the pair withdrew by -0.12% or 0.127 and closed the week lower at 109.060.

On May 2, the funds' rate sustained the target of 1.5 percent to 1.75 percent according to the Federal Open Market Committee, which is already anticipated. They say that the overall inflation excluding food and energy is close to the two percent. The economy has improved as the business fixed investment grew more steadfast.

Unanimously, the committee has decided to keep the rates unchanged disregarding the expectation of public for an aggressive course of action. Various officials are scheduled to have their speech in the upcoming days.

Fed has not given any signals to the pace of future hikes which investors believe to be implemented twice with the next rate hike anticipated in June. Subsequent rate hikes will probably be around after four months or on the last month of the year.

As they aim to hold the rate hikes twice with the not-so-good U.S. Non-Farm Payrolls report on Friday. The headline resulted below expectations as the unemployment rate reached an 18-year low. The average hourly earning seems to have the inflation out of control.

Selling pressure would persist to control the USD/JPY pair this week with investors continue to book profits after the Fed announcement on Wednesday, as well as, the U.S. jobs report on Friday.

The sentiment of the Federal Reserve was relatively dovish while allowing the inflation to purse the two percent target. Moreover, the wage growth did not meet expectations on the employment report released on Friday.

Besides the bullish trend of the 10-year Treasury notes futures contract which inversely affects the drop of yields, traders were able to place money on the net short position of the 10-year futures, with over 1 million shorts, according to the Commodity Futures Trading Commission.

However, the USD/JPY could decline sharply if these shorts start to cover.

Based on the latest reports, the inflation will be the main focus due to the anticipated release on the Producer s on Wednesday and Consumer Price on Thursday.

Some speakers including the Fed Chair Jerome Powell will have an assembly on Wednesday at 19.15 GMT.

Investors are observing the movement of the 10-year U.S. Treasury note futures contract following the appreciation of the USD/JPY pair. The statements and the recent jobs report influencing the 10-year Treasury notes, which is likely to be bullish especially that it is in inverse relationship to the interest rates. An increase in the T-notes would then lead to a drop in yields. A weaker Treasury yield would bring pressure to the Japanese major pair.

The USD/JPY pair began the week with higher expectations of the interest rates prior to the latest Fed monetary policy statement yet, the price movements suggests the disappointment to the reports. The pair rallied for the week to the highest level at 110.028 since February 5. However, the pair withdrew by -0.12% or 0.127 and closed the week lower at 109.060.

On May 2, the funds' rate sustained the target of 1.5 percent to 1.75 percent according to the Federal Open Market Committee, which is already anticipated. They say that the overall inflation excluding food and energy is close to the two percent. The economy has improved as the business fixed investment grew more steadfast.

Unanimously, the committee has decided to keep the rates unchanged disregarding the expectation of public for an aggressive course of action. Various officials are scheduled to have their speech in the upcoming days.

Fed has not given any signals to the pace of future hikes which investors believe to be implemented twice with the next rate hike anticipated in June. Subsequent rate hikes will probably be around after four months or on the last month of the year.

As they aim to hold the rate hikes twice with the not-so-good U.S. Non-Farm Payrolls report on Friday. The headline resulted below expectations as the unemployment rate reached an 18-year low. The average hourly earning seems to have the inflation out of control.

Selling pressure would persist to control the USD/JPY pair this week with investors continue to book profits after the Fed announcement on Wednesday, as well as, the U.S. jobs report on Friday.

The sentiment of the Federal Reserve was relatively dovish while allowing the inflation to purse the two percent target. Moreover, the wage growth did not meet expectations on the employment report released on Friday.

Besides the bullish trend of the 10-year Treasury notes futures contract which inversely affects the drop of yields, traders were able to place money on the net short position of the 10-year futures, with over 1 million shorts, according to the Commodity Futures Trading Commission.

However, the USD/JPY could decline sharply if these shorts start to cover.

Based on the latest reports, the inflation will be the main focus due to the anticipated release on the Producer s on Wednesday and Consumer Price on Thursday.

Some speakers including the Fed Chair Jerome Powell will have an assembly on Wednesday at 19.15 GMT.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

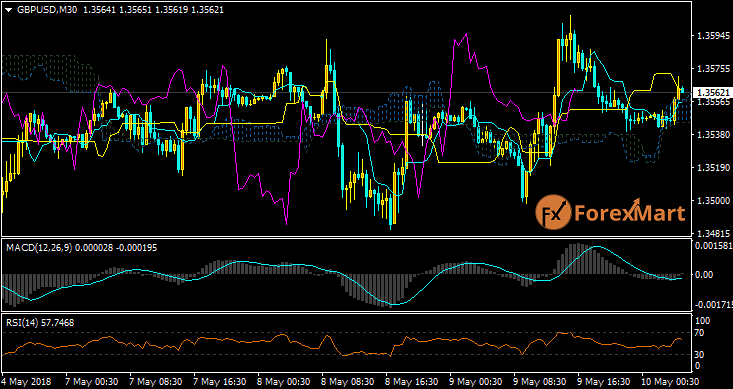

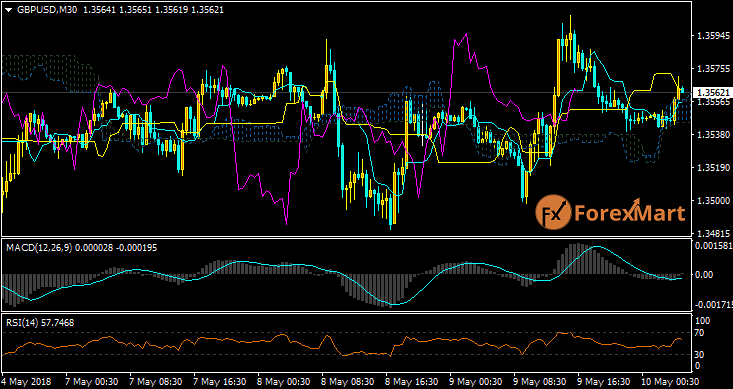

GBP/USD Technical Analysis: May 9, 2018

The British pound declined almost throughout the Tuesday session in order to test the major uptrend line once again. The 1.35 level is still significant given that it is psychologically relevant. There is also a lot of buying and selling in this area previously, which, at the same time, coincides with the major upward line. Hence, in consideration of these factors, there will be a decision soon.

The British currency dropped during the Tuesday session in reaching the uptrend line at 1.35 level. Essentially, a breakdown below could push the price further towards 1.33. Ultimately, a breakdown could loosen up sharply since the uptrend line is important. The level of 1.30 if a significant level as much as the 1.35 handle. I presume that a breakdown is logical since the U.S. dollar continues to strengthen in the summer season.

The European Central Bank has already announced that interest rates will be maintained a bit lower for a period of time that previously considered, which, in turn, added pressure on Sterling. Although this might be just for short-term and in the next few months, it is likely for buyers to return in this currency. However, the U.S. dollar will probably grow in the upcoming months which would greatly affect the currencies relative to the bond market and of course interest rate expectations. Alternately, if a breakout occurs at 1.3650 level, then there is a chance for a kick in upward momentum.

The British pound declined almost throughout the Tuesday session in order to test the major uptrend line once again. The 1.35 level is still significant given that it is psychologically relevant. There is also a lot of buying and selling in this area previously, which, at the same time, coincides with the major upward line. Hence, in consideration of these factors, there will be a decision soon.

The British currency dropped during the Tuesday session in reaching the uptrend line at 1.35 level. Essentially, a breakdown below could push the price further towards 1.33. Ultimately, a breakdown could loosen up sharply since the uptrend line is important. The level of 1.30 if a significant level as much as the 1.35 handle. I presume that a breakdown is logical since the U.S. dollar continues to strengthen in the summer season.

The European Central Bank has already announced that interest rates will be maintained a bit lower for a period of time that previously considered, which, in turn, added pressure on Sterling. Although this might be just for short-term and in the next few months, it is likely for buyers to return in this currency. However, the U.S. dollar will probably grow in the upcoming months which would greatly affect the currencies relative to the bond market and of course interest rate expectations. Alternately, if a breakout occurs at 1.3650 level, then there is a chance for a kick in upward momentum.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

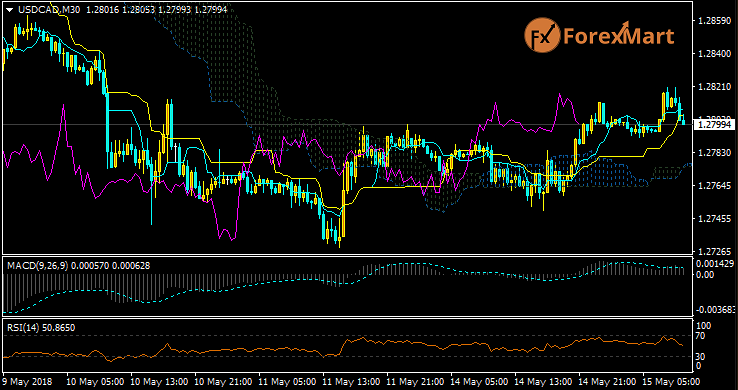

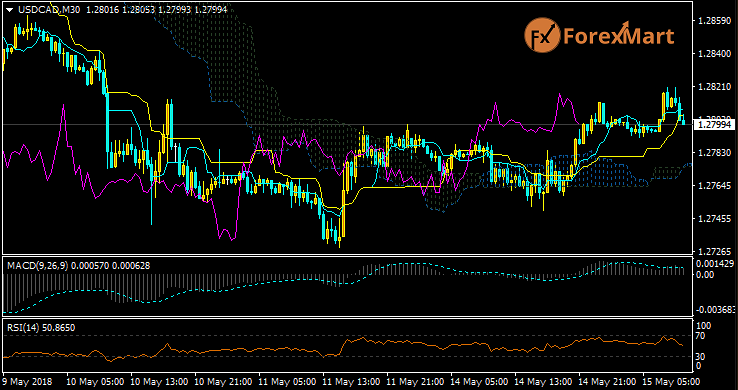

USD/CAD Technical Analysis: May 15, 2018

The week began for the US dollar against the Canadian dollar in testing the psychological level of 1.2750 for support. The market will probably stay in this area and bounce more than once.

During the Monday trading session, the greenback slid lower and reaches the level of 1.2750. If the pair breaks down again below the 1.27 level, the price could further go down towards 1.25. Alternately, if the price breaks above the level of 1.28 instead, the next course will be towards 1.30. Noise will still be present in the market around the said level with a lot of variable factors to affect the trades. The U.S. is likely to pick up momentum due to higher interest rates again in the previous weeks but it was not favorable for the greenback yesterday.

The oil is starting to rally again but could add more pressure on the market. We should focus on the 10-year treasury note in the United States and if the interest rates drop as well, this is a bad sign that would propel the market lower. There is a lot happening for the Canadian dollar yet above the level of 1.30 offers a lot of resistance, which is very apparent on the trend, with a lot of noise for a while now. In case that the market breaks through above 1.30 for some time, the price will continue to climb higher. Otherwise, we should anticipate a lot of noise for the bank and a technician to rise higher for a bit.

The week began for the US dollar against the Canadian dollar in testing the psychological level of 1.2750 for support. The market will probably stay in this area and bounce more than once.

During the Monday trading session, the greenback slid lower and reaches the level of 1.2750. If the pair breaks down again below the 1.27 level, the price could further go down towards 1.25. Alternately, if the price breaks above the level of 1.28 instead, the next course will be towards 1.30. Noise will still be present in the market around the said level with a lot of variable factors to affect the trades. The U.S. is likely to pick up momentum due to higher interest rates again in the previous weeks but it was not favorable for the greenback yesterday.

The oil is starting to rally again but could add more pressure on the market. We should focus on the 10-year treasury note in the United States and if the interest rates drop as well, this is a bad sign that would propel the market lower. There is a lot happening for the Canadian dollar yet above the level of 1.30 offers a lot of resistance, which is very apparent on the trend, with a lot of noise for a while now. In case that the market breaks through above 1.30 for some time, the price will continue to climb higher. Otherwise, we should anticipate a lot of noise for the bank and a technician to rise higher for a bit.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

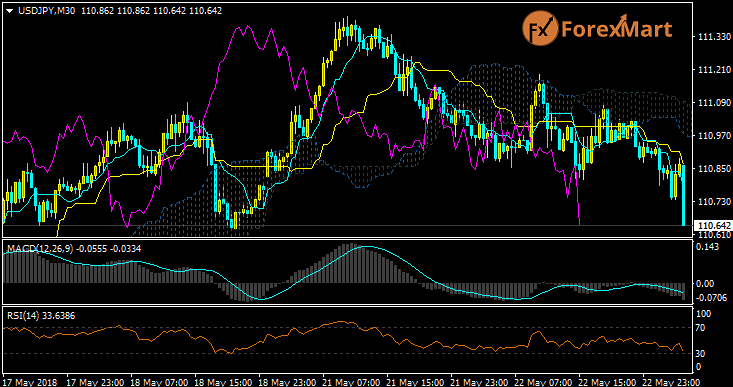

GBP/USD Technical Analysis: May 22, 2018

The British pound slightly declined at the beginning of the Monday session as it reached the level of 1.34 before finding buyers. Since there are still signs of support, it looks like it supported the fight for buyers. Yet, there are some major concerns above.

Trading the British major currency pair slid down towards the psychological level of 1.34 before going up again. It has shown a significant amount of bullish pressure but there could also be signs of significant resistance in the previous uptrend line, established in the yellow ellipse on the chart. This gives a significant amount of resistance with a high probability of a rollover then we could look for the level 1.34 below, which was also supportive in the past. A breakdown below would allow the market for a decline up to the level of 1.33 and further to 1.30.

We should be cautious of any rally, at least not until a successful breakout to 1.3550. For now, we could reverse the whole situation completely, but I think there will also be a continuation of dollar strengthening in the short-term, which is likely to extend for the rest of the summer and continue its rally in the U.S. When a breakdown occurs below the uptrend line, this could become a problem for the British pound. Although, it may not necessarily be a problem as much as the strengthening of the U.S. dollar. I would look for some type of exhaustive candle near the area of 1.3475 to begin shorting this pair.

The British pound slightly declined at the beginning of the Monday session as it reached the level of 1.34 before finding buyers. Since there are still signs of support, it looks like it supported the fight for buyers. Yet, there are some major concerns above.

Trading the British major currency pair slid down towards the psychological level of 1.34 before going up again. It has shown a significant amount of bullish pressure but there could also be signs of significant resistance in the previous uptrend line, established in the yellow ellipse on the chart. This gives a significant amount of resistance with a high probability of a rollover then we could look for the level 1.34 below, which was also supportive in the past. A breakdown below would allow the market for a decline up to the level of 1.33 and further to 1.30.

We should be cautious of any rally, at least not until a successful breakout to 1.3550. For now, we could reverse the whole situation completely, but I think there will also be a continuation of dollar strengthening in the short-term, which is likely to extend for the rest of the summer and continue its rally in the U.S. When a breakdown occurs below the uptrend line, this could become a problem for the British pound. Although, it may not necessarily be a problem as much as the strengthening of the U.S. dollar. I would look for some type of exhaustive candle near the area of 1.3475 to begin shorting this pair.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

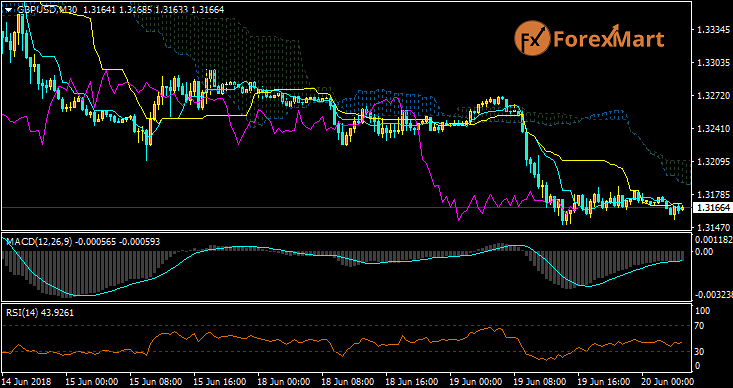

GBP/USD Fundamental Analysis: June 11, 2018

The pound/dollar pair continued to trade around the 1.3430 region on the back of the failure to create bullish momentum in the previous week, as it was beaten by the major handle and the markets are waiting for further progress in Brexit this week. Due to the scheduled FOMC rate hike in the upcoming week, the interest rate differential of the GBP and the USD is predicted to move in different directions which could hold the Pound on its starting position and push the British currency into the recent lows. Following the recently rejected Irish border solution, market participants await for further news within this week while the United Kingdom continue to negotiate in looking for the middle ground for the hard-line Brexiteers and the EU leadership in Brussels. Nevertheless, Prime Minister Theresa May was caught in between and trying to find fair solutions for both sides.

The upcoming week is projected to be really busy for the Sterling pound since 4 out of 5 trading session this week brought extreme impact to the UK calendar that could support a high level of volatility for market players. Today has plenty of data for Britain which will be all published at 08:30 GMT, however, the focus will be on the Manufacturing Industrial Production data which is expected to remain unchanged at 2.9%. The US session today appears to be in smooth sailing according to the economic calendar, but traders might deal with the G7 summit blowout, wherein US President Donald Trump leave the summit earlier and depart the US’ support of the G7 communiqué, following a Tweet from POTUS aboard Air Force One heads to Singapore for the Trump-Kim summit.

At the same time, the figures for Average Earnings Index +Bonus (Apr), Claimant Count Change (May), Core CPI & PPI input and Core retail sales in the next three consecutive trading sessions. Moreover, the daily chart indicates that the GBP/USD currency pair corrected higher from the lows of 1.3205 alongside the diverging technical oscillators. On the other hand, the Relative Strength Index (RSI) had an unexpected move towards the oversold area and bounced back to the GBP, which descends to the levels of the beginning of last week. The Slow Stochastic resumed moving in an upward trajectory. The daily chart of the 50-day and 100-day moving average formed a death star crossover, this means that there is an initial downside potential of the Cable pair to break the 1.3300 region prior attacking the area of 1.3200. The upside of the pair is necessary to break back above the 1.3380 to the 1.3450 target, which is the last week’s high.

The pound/dollar pair continued to trade around the 1.3430 region on the back of the failure to create bullish momentum in the previous week, as it was beaten by the major handle and the markets are waiting for further progress in Brexit this week. Due to the scheduled FOMC rate hike in the upcoming week, the interest rate differential of the GBP and the USD is predicted to move in different directions which could hold the Pound on its starting position and push the British currency into the recent lows. Following the recently rejected Irish border solution, market participants await for further news within this week while the United Kingdom continue to negotiate in looking for the middle ground for the hard-line Brexiteers and the EU leadership in Brussels. Nevertheless, Prime Minister Theresa May was caught in between and trying to find fair solutions for both sides.

The upcoming week is projected to be really busy for the Sterling pound since 4 out of 5 trading session this week brought extreme impact to the UK calendar that could support a high level of volatility for market players. Today has plenty of data for Britain which will be all published at 08:30 GMT, however, the focus will be on the Manufacturing Industrial Production data which is expected to remain unchanged at 2.9%. The US session today appears to be in smooth sailing according to the economic calendar, but traders might deal with the G7 summit blowout, wherein US President Donald Trump leave the summit earlier and depart the US’ support of the G7 communiqué, following a Tweet from POTUS aboard Air Force One heads to Singapore for the Trump-Kim summit.

At the same time, the figures for Average Earnings Index +Bonus (Apr), Claimant Count Change (May), Core CPI & PPI input and Core retail sales in the next three consecutive trading sessions. Moreover, the daily chart indicates that the GBP/USD currency pair corrected higher from the lows of 1.3205 alongside the diverging technical oscillators. On the other hand, the Relative Strength Index (RSI) had an unexpected move towards the oversold area and bounced back to the GBP, which descends to the levels of the beginning of last week. The Slow Stochastic resumed moving in an upward trajectory. The daily chart of the 50-day and 100-day moving average formed a death star crossover, this means that there is an initial downside potential of the Cable pair to break the 1.3300 region prior attacking the area of 1.3200. The upside of the pair is necessary to break back above the 1.3380 to the 1.3450 target, which is the last week’s high.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

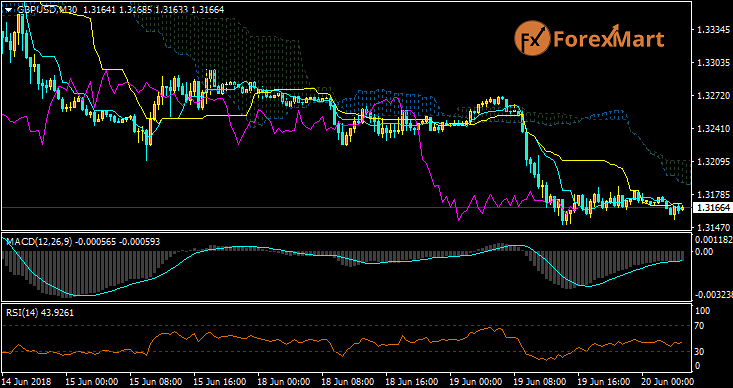

GBP/USD Technical Analysis: June 18, 2018

The British pound was able to dodge the immediate impact of the rise of the dollar while the euro dropped by two significant points that dominate the market in the previous week. The dollar gained from the rate hike which started by the Fed and the positive outlook of the Fed in the economy.

The hawkish sentiments gave t chance to the dollar to rise and the dollar bulls to plan ahead with two more rate hikes to look forward to. The Fed gives similar signals which still yet to be seen if they would continue the process and they would implement this in a specific period of time later on. We have witnessed that the rate hike would have minimal impact on the market, especially on the pound.

It seems that everything is going smoothly in the UK as the Brexit negotiation starts to advance and there are no signs of risks yet. Hence, the pound maintained its position in the support area despite the strengthening of the dollar and activities in the eurozone. The European Central Bank decided to extend the easing program which in turn, weakened the euro. Although, these things did not really affect the pound as it continues to trade close to the area of 1.32.

There are some strong purchasing in this area, as well as at the level of 1.30. Once this is achieved, the lead will be in the hands of the bulls which is likely to be maintained in short term. It seems that there is also no major event to affect the movements and we can say that the price is in consolidation and persists to be within the range for the day.

The British pound was able to dodge the immediate impact of the rise of the dollar while the euro dropped by two significant points that dominate the market in the previous week. The dollar gained from the rate hike which started by the Fed and the positive outlook of the Fed in the economy.

The hawkish sentiments gave t chance to the dollar to rise and the dollar bulls to plan ahead with two more rate hikes to look forward to. The Fed gives similar signals which still yet to be seen if they would continue the process and they would implement this in a specific period of time later on. We have witnessed that the rate hike would have minimal impact on the market, especially on the pound.

It seems that everything is going smoothly in the UK as the Brexit negotiation starts to advance and there are no signs of risks yet. Hence, the pound maintained its position in the support area despite the strengthening of the dollar and activities in the eurozone. The European Central Bank decided to extend the easing program which in turn, weakened the euro. Although, these things did not really affect the pound as it continues to trade close to the area of 1.32.

There are some strong purchasing in this area, as well as at the level of 1.30. Once this is achieved, the lead will be in the hands of the bulls which is likely to be maintained in short term. It seems that there is also no major event to affect the movements and we can say that the price is in consolidation and persists to be within the range for the day.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

GBP/USD Technical Analysis: June 19, 2018

The Sterling pound slightly weakened amid Monday trading course and further moved lower to the 1.32 zone. This level is considered a round psychological significant number but it seems that the market will search for additional support below the 1.30 area. It is also possible that rally sell-off will resume since the American dollar is expected to continue to attract traders who badly need protection.

A break over the 1.33 handle would allow a higher move to 1.34 level. After the extreme sell-off on Thursday, this would be a difficult scenario to reverse things, and the momentum is believed to be on the side of the sellers regardless of any situation. Forecasts also show that the level below 1.30 would likely be a massive support area and a break down beneath indicates a negative scenario.

There is high chance that the market will see a “sell the rallies” type of consolidation in the near-term, which means pushing a move to the downside in the longer-term. Nevertheless, good news could help to turn things around.

The Sterling pound slightly weakened amid Monday trading course and further moved lower to the 1.32 zone. This level is considered a round psychological significant number but it seems that the market will search for additional support below the 1.30 area. It is also possible that rally sell-off will resume since the American dollar is expected to continue to attract traders who badly need protection.

A break over the 1.33 handle would allow a higher move to 1.34 level. After the extreme sell-off on Thursday, this would be a difficult scenario to reverse things, and the momentum is believed to be on the side of the sellers regardless of any situation. Forecasts also show that the level below 1.30 would likely be a massive support area and a break down beneath indicates a negative scenario.

There is high chance that the market will see a “sell the rallies” type of consolidation in the near-term, which means pushing a move to the downside in the longer-term. Nevertheless, good news could help to turn things around.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

AUD/USD Technical Analysis: June 27, 2018

The Australian currency had slightly decline amid trading course on Tuesday and was able to touch the 0.74 level below. According to the chart, the light blue circle that formed a “W pattern” at 0.7350 zone indicates some bullish reversal signal, the said level is considered significant in the longer-term chart. With this, it seems that we are in a neutral position attempting to reverse the overall market sentiment which would cause a lot of noise.

In case that market will break on top of the 0.75 handle, this shows a bullish sign which appears to hang in the trade of a significant trend in the longer-term. Below this zone seems to offer enough support to help the market buoyed. In general, the market may continue to be noisy but holding a position above the significant area of 0.7350 would likely attract more buyers.

Aside from that, the weekly charts generated a massive hammer formation last week which showed a bullish sign, as expected. Hence, there is low chance to have a good rebound which is in favor of the short-term charts. Otherwise, a break under the 0.7350 mark would pull down the market toward 0.70 zone.

The Australian currency had slightly decline amid trading course on Tuesday and was able to touch the 0.74 level below. According to the chart, the light blue circle that formed a “W pattern” at 0.7350 zone indicates some bullish reversal signal, the said level is considered significant in the longer-term chart. With this, it seems that we are in a neutral position attempting to reverse the overall market sentiment which would cause a lot of noise.

In case that market will break on top of the 0.75 handle, this shows a bullish sign which appears to hang in the trade of a significant trend in the longer-term. Below this zone seems to offer enough support to help the market buoyed. In general, the market may continue to be noisy but holding a position above the significant area of 0.7350 would likely attract more buyers.

Aside from that, the weekly charts generated a massive hammer formation last week which showed a bullish sign, as expected. Hence, there is low chance to have a good rebound which is in favor of the short-term charts. Otherwise, a break under the 0.7350 mark would pull down the market toward 0.70 zone.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

GBP/JPY Technical Analysis: June 28, 2018

The British currency had seesawed during Wednesday trading session and rebounded from the ascending trend line below to turn around and touches the ¥145.33 level. Apparently, the market will continue to have a lot of noise in general due to fears about trade wars. However, there are certain attempts to seriously break down through the upward trendline that can be seen on the hourly. An ability to move under that level would allow the market to reach the ¥144.50 level or lower.

Otherwise, the market might bounce from that point when some good news was released. From there, the market is expected to go near the ¥146 level, which is an area of resistance barrier of various minor in between that requires a significant amount of momentum to gain a position above.

Remember that the GBP/JPY pair is predicted to be extremely volatile and highly sensitive with regards the news and current issue between China and the United States. It is believed that this market is going to receive a lot of bad news despite the significant bounce from the remarks of Donald Trump that he is not interested to further heighten the trade war to hold China from investing in the US technological firms.

The British currency had seesawed during Wednesday trading session and rebounded from the ascending trend line below to turn around and touches the ¥145.33 level. Apparently, the market will continue to have a lot of noise in general due to fears about trade wars. However, there are certain attempts to seriously break down through the upward trendline that can be seen on the hourly. An ability to move under that level would allow the market to reach the ¥144.50 level or lower.

Otherwise, the market might bounce from that point when some good news was released. From there, the market is expected to go near the ¥146 level, which is an area of resistance barrier of various minor in between that requires a significant amount of momentum to gain a position above.

Remember that the GBP/JPY pair is predicted to be extremely volatile and highly sensitive with regards the news and current issue between China and the United States. It is believed that this market is going to receive a lot of bad news despite the significant bounce from the remarks of Donald Trump that he is not interested to further heighten the trade war to hold China from investing in the US technological firms.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

AUD/USD Technical Analysis: July 3, 2018

The Aussie dollar had a significant break down during the trading course yesterday and further cut through the 0.7350 zone. There is a lot of support underneath that level and it appears that players attempt to slice through it. If this happens, the market would likely move to the 0.73 handle or even to the 0.72 mark eventually. At present, rallies may be sold-off since Sino-American affiliation continue to fall apart. The nearing deadline for the trade tariff on Friday appears to be true but traders are also concerned about China’s retaliation plans.

Market players will be confident to buy the Australian dollar again until the trade pressures eased down due to bid for safety. As of this writing, the market may drive lower but traders might experience an occasional bounce. Also, the markets may resume moving based on the headlines while the downside may be the most convenient way to trade, considering that the markets avoid risks.

The Aussie dollar had a significant break down during the trading course yesterday and further cut through the 0.7350 zone. There is a lot of support underneath that level and it appears that players attempt to slice through it. If this happens, the market would likely move to the 0.73 handle or even to the 0.72 mark eventually. At present, rallies may be sold-off since Sino-American affiliation continue to fall apart. The nearing deadline for the trade tariff on Friday appears to be true but traders are also concerned about China’s retaliation plans.

Market players will be confident to buy the Australian dollar again until the trade pressures eased down due to bid for safety. As of this writing, the market may drive lower but traders might experience an occasional bounce. Also, the markets may resume moving based on the headlines while the downside may be the most convenient way to trade, considering that the markets avoid risks.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Daily Market Analysis from ForexMart

Daily Market Analysis from ForexMart

GBP/USD Technical Analysis: July 4, 2018

The British currency had a significant rally during trading course yesterday and further reach the important region of 1.32. It seems that the market will continue to search for sellers around that level, while a break on top of that area will show the next target above the 1.33 mark. This market remains to be very noisy, however, the market is predicted to move according to headlines and uncertainties at the end of the day.

The hourly chart formed a “higher low” but it is too soon to consider the market reversal in the longer-term. Forecasts show that the greenbacks would likely continue to gain strength in general while traders buy additional treasuries. Aside from that, there is some unknown factor relative to the United Kingdom and participants should take extra care.

Since today is the Independence Day holiday in the United States, we should anticipate a very noisy market unless liquidity will flow intensely that could prompt further shocking news. Generally, we can expect for some quiet fluctuation in the trading area.

The British currency had a significant rally during trading course yesterday and further reach the important region of 1.32. It seems that the market will continue to search for sellers around that level, while a break on top of that area will show the next target above the 1.33 mark. This market remains to be very noisy, however, the market is predicted to move according to headlines and uncertainties at the end of the day.

The hourly chart formed a “higher low” but it is too soon to consider the market reversal in the longer-term. Forecasts show that the greenbacks would likely continue to gain strength in general while traders buy additional treasuries. Aside from that, there is some unknown factor relative to the United Kingdom and participants should take extra care.

Since today is the Independence Day holiday in the United States, we should anticipate a very noisy market unless liquidity will flow intensely that could prompt further shocking news. Generally, we can expect for some quiet fluctuation in the trading area.

Andrea ForexMart- Posts : 35

Points : 11254

Join date : 2018-03-09

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

GBP/JPY Technical Analysis: July 17, 2018

The British pound rallied a little during the Monday session and reaches the level of 149.50 before apparent signs of exhaustion. Higher than 150 signifies exhaustion in the market with expected resistance. Thus, we could strike on the opportunity to short this pair. It looks like the market has overexpanded and faces strong psychological level above 150.

Although it is still suggested to short this pair in a smaller move, the long-term selling will bring the rates back to 150. A break higher would give the green light to traders in applying the “buy and hold” strategy yet, the strong political tension around Britain could strengthen the Sterling pound for long-term. The pair will continue to chop around and eventually make way for some clarity that the trend lacks as of the moment. For the short term, sellers are anticipated to be present while more sellers will join in the long-term above the trend. Nevertheless, we should keep the possibilities open as it may change anytime. Noise will still be present because of the political tension in the U.K. and global risk appetite. Hence, small trades will be the ideal approach for this market since noise will be the main impulse in overall trading while headlines will likely cause sudden movements in short-term.

=

The British pound rallied a little during the Monday session and reaches the level of 149.50 before apparent signs of exhaustion. Higher than 150 signifies exhaustion in the market with expected resistance. Thus, we could strike on the opportunity to short this pair. It looks like the market has overexpanded and faces strong psychological level above 150.

Although it is still suggested to short this pair in a smaller move, the long-term selling will bring the rates back to 150. A break higher would give the green light to traders in applying the “buy and hold” strategy yet, the strong political tension around Britain could strengthen the Sterling pound for long-term. The pair will continue to chop around and eventually make way for some clarity that the trend lacks as of the moment. For the short term, sellers are anticipated to be present while more sellers will join in the long-term above the trend. Nevertheless, we should keep the possibilities open as it may change anytime. Noise will still be present because of the political tension in the U.K. and global risk appetite. Hence, small trades will be the ideal approach for this market since noise will be the main impulse in overall trading while headlines will likely cause sudden movements in short-term.

=

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

EUR/USD Technical Analysis: July 18, 2018

The euro rallied at the beginning of the Tuesday session and reach up to 1.1750 prior to retreating back at 1.700 below, which were the trades began for the day. We can expect noise to be present in the pair considering that there are Brexit negotiations and a strong dollar. Yet, looking at the charts, clearly, it shows that the true resistance would be above 1.1850 while the floor of the pair can be found at 1.15 below.

Given the high frequency in trading, there is a huge amount of volatility in the EUR/USD pair. At the end of the day, the 1.17 level offers support which is a good indicator or further goes up on Wednesday. Also, the 1.1675 level offers support where there is also a high demand. I assume that the market will look for value on dips, especially for hunters. Yet, traders should still be careful in putting money at stakes. Hence, I would suggest to trade slowly and then gradually add more to reach new fresh highs.

In general, the pair could stay long in consolidation range which should be considered given that there will be a lot of noise and headlines could influence the pair for sudden movements.

The euro rallied at the beginning of the Tuesday session and reach up to 1.1750 prior to retreating back at 1.700 below, which were the trades began for the day. We can expect noise to be present in the pair considering that there are Brexit negotiations and a strong dollar. Yet, looking at the charts, clearly, it shows that the true resistance would be above 1.1850 while the floor of the pair can be found at 1.15 below.

Given the high frequency in trading, there is a huge amount of volatility in the EUR/USD pair. At the end of the day, the 1.17 level offers support which is a good indicator or further goes up on Wednesday. Also, the 1.1675 level offers support where there is also a high demand. I assume that the market will look for value on dips, especially for hunters. Yet, traders should still be careful in putting money at stakes. Hence, I would suggest to trade slowly and then gradually add more to reach new fresh highs.

In general, the pair could stay long in consolidation range which should be considered given that there will be a lot of noise and headlines could influence the pair for sudden movements.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

EUR/USD Technical Analysis: July 19, 2018

The euro against the U.S. dollar is traded slightly in the area of 1.1650 but profits can be gained during the European session. The uptrend took place in the early hours of Asian market session due to recent bullish trend across the globe booking profits on the dollar. Yet, the outlook of the greenback is still optimistic because of hawkish rhetorics from the U.S. Fed chair Jerome Powell, which would probably affect the European and American session. Stocks on major world market reached a one-month high on Wednesday after strong corporate earnings. Meanwhile, the U.S. surpassed the levels on a three-week high against major currencies with more bidding involving the dollar. Yet, the profit booking activity slowed down the momentum of the dollar for a while. According to Powell, the United States would go for a steady growth in the course of trading and held back risks of the U.S. economy on worsening trade conflict.

The dollar index grew towards 95.4, reaching a three-week high against other currencies and then settled in the area of 95.08 with an increase of 0.2%. Two more rate hikes are anticipated this year from the Federal Reserve in reaction to rising inflationary pressures. On the other hand, the ECB is presumed to raise their rates only in the middle of next year. The eurozone grew for the first time last year since the financial crisis between 2007 and 2008. Yet, the most recent survey of 100 economists results showed growth momentum has already reached the highest point. Nonetheless, the worsening trade war between the U.S. and their trading partners still presents real risks to the eurozone and influenced economists to lessen their growth forecast.

The euro against the U.S. dollar is traded slightly in the area of 1.1650 but profits can be gained during the European session. The uptrend took place in the early hours of Asian market session due to recent bullish trend across the globe booking profits on the dollar. Yet, the outlook of the greenback is still optimistic because of hawkish rhetorics from the U.S. Fed chair Jerome Powell, which would probably affect the European and American session. Stocks on major world market reached a one-month high on Wednesday after strong corporate earnings. Meanwhile, the U.S. surpassed the levels on a three-week high against major currencies with more bidding involving the dollar. Yet, the profit booking activity slowed down the momentum of the dollar for a while. According to Powell, the United States would go for a steady growth in the course of trading and held back risks of the U.S. economy on worsening trade conflict.

The dollar index grew towards 95.4, reaching a three-week high against other currencies and then settled in the area of 95.08 with an increase of 0.2%. Two more rate hikes are anticipated this year from the Federal Reserve in reaction to rising inflationary pressures. On the other hand, the ECB is presumed to raise their rates only in the middle of next year. The eurozone grew for the first time last year since the financial crisis between 2007 and 2008. Yet, the most recent survey of 100 economists results showed growth momentum has already reached the highest point. Nonetheless, the worsening trade war between the U.S. and their trading partners still presents real risks to the eurozone and influenced economists to lessen their growth forecast.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

EUR/USD Technical Analysis: July 20, 2018

The single European currency had broken down amid trading course on Thursday while a lot of negativity continue to be in this market. Forecasts say that the market would likely continue to be volatile but the market is determined to move lower near the 1.15 region, an area which has been a significant support in the past and a little bit of buying pressure can be seen in this zone. While the current point of at issue is whether or not traders can break down beneath that level. A successful break down will be a great destruction for the Euro.

Otherwise, a rally from that level and regain the 1.16 zone has a high probability to happen. In that case, we could determine a move on top of the 1.1660 region followed by a potential rally. We can see the overall consolidation below the 1.15 area, which serves as the floor and 1.1850 above as the ceiling of consolidation where we are currently fixed.

It looks like that we will be stuck in this range for the next couple of days or weeks since it's already mid-summer and there many large traders from all over the world who are out of their offices. Aside from that, there are also varying issues regarding the Brexit which causes trading quite noisy and difficult for the EUR/USD currency pair.

The single European currency had broken down amid trading course on Thursday while a lot of negativity continue to be in this market. Forecasts say that the market would likely continue to be volatile but the market is determined to move lower near the 1.15 region, an area which has been a significant support in the past and a little bit of buying pressure can be seen in this zone. While the current point of at issue is whether or not traders can break down beneath that level. A successful break down will be a great destruction for the Euro.

Otherwise, a rally from that level and regain the 1.16 zone has a high probability to happen. In that case, we could determine a move on top of the 1.1660 region followed by a potential rally. We can see the overall consolidation below the 1.15 area, which serves as the floor and 1.1850 above as the ceiling of consolidation where we are currently fixed.

It looks like that we will be stuck in this range for the next couple of days or weeks since it's already mid-summer and there many large traders from all over the world who are out of their offices. Aside from that, there are also varying issues regarding the Brexit which causes trading quite noisy and difficult for the EUR/USD currency pair.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

AUD/USD Technical Analysis: July 23, 2018

The Australian dollar against the U.S. dollar trades a bit higher during the Monday session. A bit of a reaction was observed as the dollar weakened due to the added pressure on the Trump’s remarks to the Fed policy and his struggle with the strengthening of the greenback.

Investors reaction to Trump’s rhetorics lead to the tight trading of the pair against the different monetary policy between the hawkish Fed and a dovish central bank of Australia that makes the dollar appealing for investment to traders alike.

Also, traders are hesitant about their positioning prior to the weekly quarterly consumer inflation data of Australian and increasing Treasury yields from the U.S.

The major trend has decline based on the daily swing chart. The trend will move up on trades towards .7443 and if it further reaches the level of .7318, the downtrend is likely to continue.

Short-term trading of the pair will be between .7310 and .7484 with 50% pivot level at .7397. It seems that pair is being traded strongly at this level that could assist an early uptrend tendency. Traders should act on it to counter the support level on the first test today. However, if it fails to hold this level, the price could weaken with the main range at .7677 to .7310. If the trend goes up, then we can expect the retracement zone to be at .7494 to .7537 which will become the primary target in the upside.

On a technical aspect, the AUD/USD pair will be based on the reaction of the pair for short-term trading at .7434.

The Australian dollar against the U.S. dollar trades a bit higher during the Monday session. A bit of a reaction was observed as the dollar weakened due to the added pressure on the Trump’s remarks to the Fed policy and his struggle with the strengthening of the greenback.

Investors reaction to Trump’s rhetorics lead to the tight trading of the pair against the different monetary policy between the hawkish Fed and a dovish central bank of Australia that makes the dollar appealing for investment to traders alike.

Also, traders are hesitant about their positioning prior to the weekly quarterly consumer inflation data of Australian and increasing Treasury yields from the U.S.

The major trend has decline based on the daily swing chart. The trend will move up on trades towards .7443 and if it further reaches the level of .7318, the downtrend is likely to continue.

Short-term trading of the pair will be between .7310 and .7484 with 50% pivot level at .7397. It seems that pair is being traded strongly at this level that could assist an early uptrend tendency. Traders should act on it to counter the support level on the first test today. However, if it fails to hold this level, the price could weaken with the main range at .7677 to .7310. If the trend goes up, then we can expect the retracement zone to be at .7494 to .7537 which will become the primary target in the upside.

On a technical aspect, the AUD/USD pair will be based on the reaction of the pair for short-term trading at .7434.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

USD/JPY Technical Analysis: July 24, 2018

Once again, the U.S. dollar dropped against the Japanese yen in day trading on Monday session. There was sufficient support found on the trendline and crossed below the level of 111 yen. It seems that the market is attempting to recover from here. Thus, a short-term bounce might still be far from happening. Predominant selling activity is due to the currency war but, nonetheless, hunters will still find this appealing to reverse the situation.

As shown on the chart, the price plunged to the uptrend line with intention to bounce up. This can actually be considered as a perfect test of the uptrend line and it looks like value hunters are will attempt to join the market now. A rebound can be bought but there will still be some noise around regardless of what happens next in the days to come. Hence, it is ideal to trade in smaller trade. Although there is sufficient amount of demand below, a lot of noise is present above. In long-term trades, there is a tendency of the pair to move because of the risk appetite. Therefore, in case that trade tension mitigates, the market might turn around.

On the other hand, if the market breaks lower than the uptrend line, the next target of the market will be the level of 110, which can serve as a support. Hence, it is likely for a correction to happen given the oversold condition of the pair, at least the in the next few trading sessions. Assessing the trend as a whole, there are higher risks on the upper channel than below but with high volatility around, traders should still be careful in trading this market.

Once again, the U.S. dollar dropped against the Japanese yen in day trading on Monday session. There was sufficient support found on the trendline and crossed below the level of 111 yen. It seems that the market is attempting to recover from here. Thus, a short-term bounce might still be far from happening. Predominant selling activity is due to the currency war but, nonetheless, hunters will still find this appealing to reverse the situation.

As shown on the chart, the price plunged to the uptrend line with intention to bounce up. This can actually be considered as a perfect test of the uptrend line and it looks like value hunters are will attempt to join the market now. A rebound can be bought but there will still be some noise around regardless of what happens next in the days to come. Hence, it is ideal to trade in smaller trade. Although there is sufficient amount of demand below, a lot of noise is present above. In long-term trades, there is a tendency of the pair to move because of the risk appetite. Therefore, in case that trade tension mitigates, the market might turn around.

On the other hand, if the market breaks lower than the uptrend line, the next target of the market will be the level of 110, which can serve as a support. Hence, it is likely for a correction to happen given the oversold condition of the pair, at least the in the next few trading sessions. Assessing the trend as a whole, there are higher risks on the upper channel than below but with high volatility around, traders should still be careful in trading this market.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Re: Daily Market Analysis from ForexMart

Re: Daily Market Analysis from ForexMart

GBP/JPY Technical Analysis: July 25, 2018

The sterling pound moved sideways amid trading session yesterday, with an exception for a slight reversal and bullish pressure. As of this writing, the ¥146 level above was unable to break. While the previous ascending trend line was broken through which stimulate a little bit of resistance. In case of a slice above the ¥147 region will prove the strength of the recovery. On the contrary, we can expect for a lot of sideways action in the near term.

There are forecasts that the area under the ¥145 will be supportive which would likely require some pressure to cut through that region. Generally, the market will contain plenty of noise with a slightly downward proclivity as to the concerns about trade battles and the like.

It should be noted that the GBP/JPY currency pair is very sensitive to global risk appetite alongside the added issue of political chaos in Great Britain, which slightly puts off this market downwards. The presence of some reversal is very difficult to deal with but if we reach higher than the ¥147 level, then new profits will pour in the trading place and would accelerate further. While a break down underneath the ¥145 level would probably open a way through the ¥142.50 region.

The sterling pound moved sideways amid trading session yesterday, with an exception for a slight reversal and bullish pressure. As of this writing, the ¥146 level above was unable to break. While the previous ascending trend line was broken through which stimulate a little bit of resistance. In case of a slice above the ¥147 region will prove the strength of the recovery. On the contrary, we can expect for a lot of sideways action in the near term.

There are forecasts that the area under the ¥145 will be supportive which would likely require some pressure to cut through that region. Generally, the market will contain plenty of noise with a slightly downward proclivity as to the concerns about trade battles and the like.

It should be noted that the GBP/JPY currency pair is very sensitive to global risk appetite alongside the added issue of political chaos in Great Britain, which slightly puts off this market downwards. The presence of some reversal is very difficult to deal with but if we reach higher than the ¥147 level, then new profits will pour in the trading place and would accelerate further. While a break down underneath the ¥145 level would probably open a way through the ¥142.50 region.

Obasi FXMart- Posts : 99

Points : 10729

Join date : 2018-07-04

Page 1 of 39 • 1, 2, 3 ... 20 ... 39

Similar topics

Similar topics» Daily Market Analysis by ForexMart

» Best PTC site - WinOnClick - Make up to 3$ daily.

» Company News by ForexMart

» Best PTC site - WinOnClick - Make up to 3$ daily.

» Company News by ForexMart

Page 1 of 39

Permissions in this forum:

You cannot reply to topics in this forum

» Company News by ForexMart

» InstaForex Company News

» Making furniture to order

» Greetings New Member

» Hi everyone

» To find out the cost of software development

» What is the most effective vitamins to support the health?

» Dresses for alternative ladie.